On both the Vested platform and AlphaScreener, we consistently see that momentum investing is the most popular approach of investing employed by users. So today, we discuss if momentum investing works.

But before we answer the question, let’s talk about what momentum investing is.

It is the act of “buying high, and selling even higher”. It is an investing strategy that is predicated on the belief that share prices of companies that are trending up will continue to do so in the medium term. Here’s an illustration of this concept:

Ideally, one can detect momentum build out early, start investing, ride the momentum, and exit before the price declines. It’s a very simple concept that is devilishly hard to execute. After all, the future is unknown. If one just buys stocks that are going up, there’s a significant risk of buying an overvalued stock and being the person to hold the bag as the share price reverts to the mean.

In short: Yes. Reports of the efficacy of momentum investing in financial research literature is quite extensive.

Jegadeesh and Titman, in their seminal 1993 paper, were the first to academically report this phenomenon. They reported that trading strategies of buying past winners and shorting past losers (there’s momentum on the way down too) can consistently be profitable. They also saw that holding these momentum portfolios for too long (24 months or longer) led to underperformance.

Now before you rush to replicate the above strategy, recognize that the paper is now 29 years old! The nature of alpha is such that, once discovered, it is lost. So has the advantage disappeared over time?

Not quite. There are plenty of research articles that try to answer this question. One of the most comprehensive is AQR’s (the Hedge Fund) paper from 2014. The authors of this paper examined 212 years of US Equity data (from 1801 to 2012), UK Equity data dating back to the Victorian age, and more than a dozen other asset classes. They discovered that Momentum return premium is persistent across time and across all these asset classes.

“momentum premium has been a part of markets for as long as there have been markets” -- source.

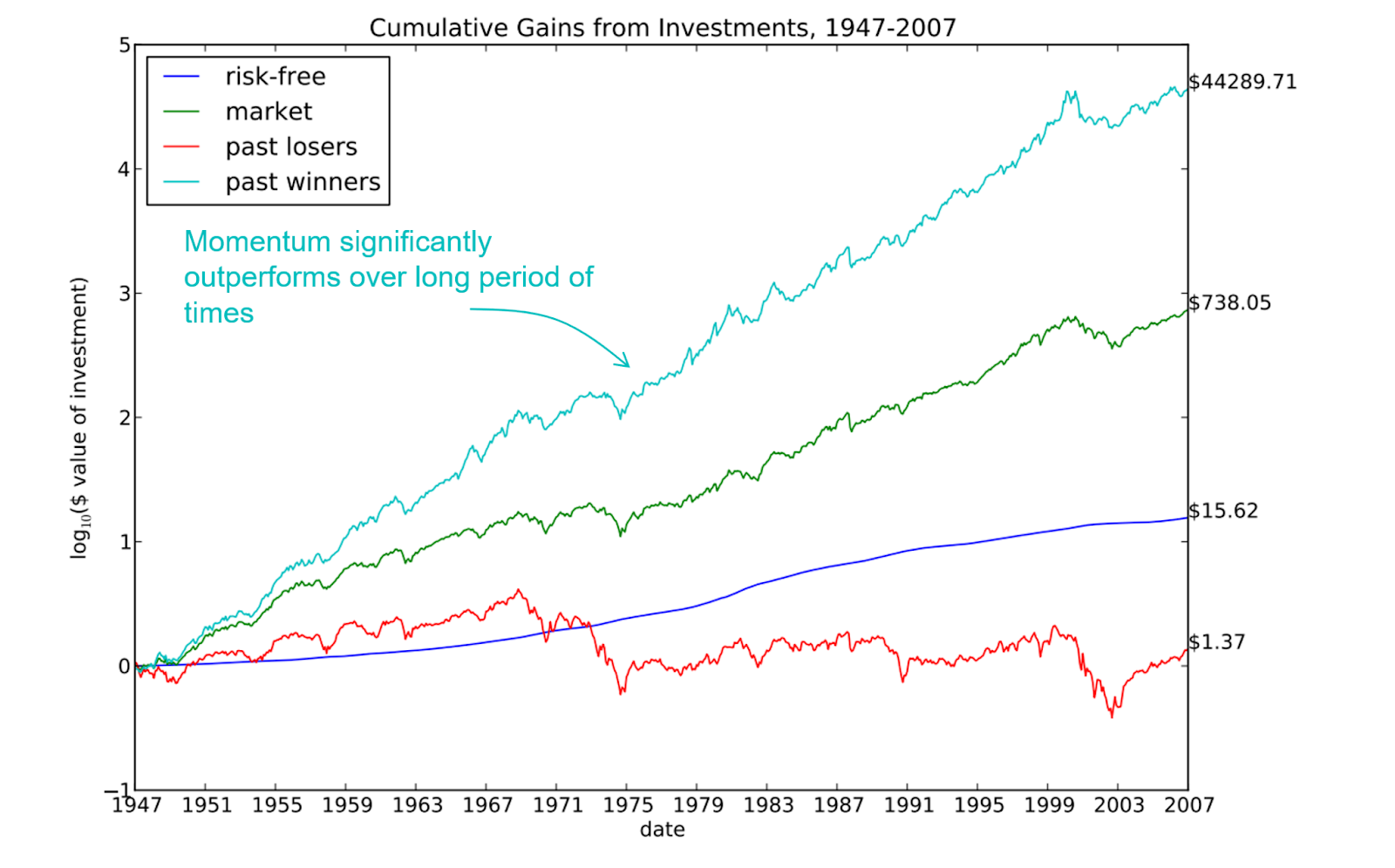

Here’s a chart of simulated returns from an application of Momentum Investing from another paper. The authors used a “buy and hold” strategy of “past winners” (high momentum stocks) with one annual rebalance. Annotations are ours.

However, momentum is not perfect. There are long periods when it does not work. The momentum strategy typically works poorly when the market is in a panic state (such as now, with the Fed rapidly increasing interest rates to combat inflation) with higher volatility.

Now that we’ve established that momentum investing can work, we need to understand why it works.

The body of literature work has boiled down the explanation to human nature.

Because the momentum effect relies on diffusion of news, the magnitude of momentum can vary depending on how much a stock is being covered. A paper from 2000 (which may not be applicable today - back internet penetration was much lower) seems to support this conclusion. In it, the authors reported that momentum investing is more effective on larger firms that have high analyst coverage.

Perhaps because the root cause of momentum is human nature, momentum effect has been so persistent, over wide ranging asset classes, and over long periods of time. And despite the fact that the effect is being actively exploited by investors, it has not dissipated. In fact, one can argue that the more momentum investing is used, the more pronounced its effects are; becoming a self fulfilling prophecy.

Alright, now, you might be thinking - if it works - how can one exploit this phenomenon? There’s an easy way and a hard way.

The easy way is to invest in momentum ETFs. BlackRock offers one (MTUM), which is an ETF that tracks large cap stocks with high momentum (they use average volatility adjusted momentum scores derived from past 6-month and 12-month returns) to form a market cap weighted ETF.

Figure 4 above shows the return of the MTUM ETF vs. the S&P 500 from 2014 to present. As you can see, MTUM outperformed the broader market for the better part of the past decade, which has been largely a bull market. But notice that the ETF gave up most of its outperformance in the past 12 months. Let’s take a closer look at the volatile period from 2020 to date (see Figure 5 below).

In Figure 5, we take a closer look at the performance from the past two years. Coming out of the 1st global lockdown market shock (March - May 2020), MTUM outperformed the market, as high momentum stocks, internet darlings, became the go-to investing strategy. But since October 2021, MTUM has given up all of its outperformance and more. Momentum stocks went out of favor as the Fed began increasing interest rates, which compressed valuations of tech stocks in particular. This is consistent with the literature report we discussed above.

The harder way to invest in momentum stock is to do it yourself. Roughly, the steps are as follows:

One way to make investing in momentum more robust is by layering it with another factor. In his report, Asness et al observed that momentum is most effective when layered with other factors.

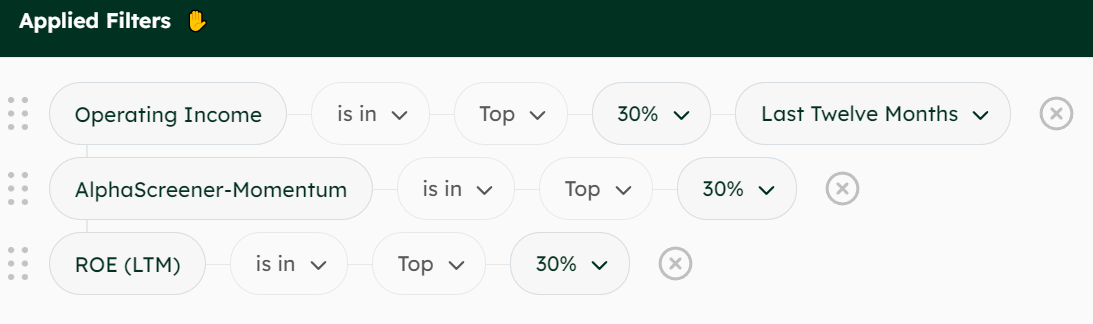

For this example, we layer momentum with quality. To do this, we created a screener (Figure 6) which comprises three filters:

We backtested this strategy using AlphaScreener. The approach assumes that one invests in a hypothetical portfolio consisting of the top 50 companies that meet the criteria above, whereby the portfolio is held for the past 20 years with an annual rebalance. The outcome is as follows:

As you can see in Figure 8 above (panel A), the hypothetical strategy outperformed the S&P 500 over the past 22 years (2000 - present). Even though it outperformed the market over the entire two decades, there are periods of underperformance, as shown in panel B (the red sections).

To analyze periods of underperformance more closely, we look at the comparison between the back test and the S&P 500 over various stress events. AlphaScreener produces this output as part of the back test function, which we show in Figure 9.

Here, you can see that our quality-momentum strategy tends to underperform the market post-stress events, especially in recent years. This is consistent with the literature reports on “momentum crashes” mentioned above. Of particular note, this hypothetical strategy significantly underperforms the market during the current market downturn (see last row of Figure 9).

Despite everyone’s constant proclamation that “past performance does not guarantee future results”, there appears to be an autocorrelation between past and future price movement. A momentum strategy is one that hinges on the fact that past performance does indeed have some predictive power of future returns. Although this appears simple in concept, momentum investing can be tricky to implement. One must apply the strategy with the following two key considerations: